nh property tax rates per town

186 of home value Tax amount varies by county The median property tax in New Hampshire is 463600 per year for a home worth the median value of 24970000. 100 rows How to Calculate Your NH Property Tax Bill 1.

Upper Valley Area Faq S Housing Solutions Real Estate

300000 1000 300 x 2306 6910 tax bill 1.

. Find NH Property Tax Rates for NH Cities and Towns and find out how much house you can afford at Pelletier Realty Group in Weare New Hampshire. 2021 Tax Rate Breakdown Goffstown. The outcome is the same when the market value of the properties increases above the assessed value in this case to 275000.

Tax Rate and Ratio History. Completed Public Tax Rates 2021 Final. When combining all local county and state property.

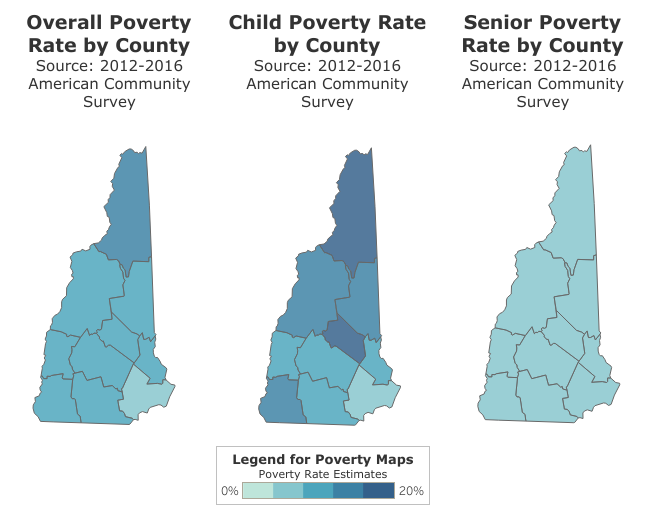

Claremont has the highest property tax rate in New Hampshire with a property tax rate of 4098. Property assessments are required to be set no later than April 1st of each calendar year. Evaluate towns by county and compare datasets including Valuation Municipal County Rate State and Local Education tax dollar amounts.

Find County Online Property Taxes Info From 2021. New Hampshire Property Tax Rates. Generally towns hire professional assessors to complete their town-wide assessments.

What is the tax rate per thousand. And you can print the information. State of New Hampshire and the Towns of Hampton North Hampton Rye Seabrook and New Castle to operate seacoast beaches during the COVID-19 pandemic.

The local tax rate where the property is situated For example the owner of a home with an assessed value of 300000 in a town where the tax rate is 2306 would receive a bill of 6910. The cost of living in Manchester NH is -109 lower than in Burlington VT. 2012 Tax Rate School 1397 State 109 Town 335 County 236.

2021 Property Tax Rate Notice. Click column headers to sort. Goffstown New Hampshire NH town website.

When combining all local county and state property taxes these towns have the highest property tax rates in New Hampshire as of January 1 2022. Employers in Manchester NH typically pay 42 more than employeers in Burlington VT. If you have any suggestions please send your thoughts.

Residents can look up their tax bills by going to. Total Rate New Hampshire Department of Revenue Administration Completed Public Tax Rates 2019 Municipality Date Valuation w Utils Total Commitment 1 200000 200000 000 000 000 Campton 112219 433123236 11137603 Canaan 102319 344646906 11289001. The July 1st first-issue.

Tax Rates are given in dollars per one thousand dollars of assessed value. The assessed value of a property along with its municipalitys tax rate is used to calculate the property tax to be paid. 6035292020 INFOPELLETIERGROUPCOM Contact Header Navigation.

Property Tax Rates -2021 Tax Rate Click to collapse. Claremont 4098 Berlin 3654 Gorham 3560 Northumberland 3531 Newport 3300 Which NH towns have the lowest property taxes. Find All The Record Information You Need Here.

Total Rate New Hampshire Department of Revenue Administration Completed Public Tax Rates 2021 Municipality Date Valuation w Utils Total Commitment 1 000 000 000 000 000 Dorchester 111721 45178890 989433 Dover 120121 4472310130 95862031. Total Rate New Hampshire Department of Revenue Administration Completed Public Tax Rates 2020 Municipality Date Valuation w Utils Total Commitment 1 000 000 000 000 000 Campton 112320 439337540 11703154 Canaan 102820 347549588 11898029. However the actual tax year runs from April 1st through March 31st of each year.

NH Property Tax Rates by Town 2018 City or Town Tax on a 278000 house see note 625 598 131 226 1580 762 981 198 232 2173 278000 is the current median home price in New Hampshire Woodstock 604094 Wolfeboro 439240 Completed Public Tax Rates Final Page 7 of 7. 2515 per thousand. State Education Property Tax Warrant.

Although the Department makes every effort to ensure the accuracy of data and information. The assessed value of the property 2. The Town of Mason is located in Hillsborough County in southern New Hampshire.

3150 per 1000 of property valuation 2022 tax rate will be issued in Fall of 2022 Property tax bills are issued twice a year in Allenstown usually due on July 1st and December 1st of each year. You would have to earn a salary of 53449 to maintain your current standard of living. Completed Public Tax Rates Final.

Ad Unsure Of The Value Of Your Property. With taxes to be raised of 10000 and a town-wide assessed value of 500000 the tax rate would remain 20 per 1000 of valuation and each property would again owe 5000 in property taxes. This is followed by Berlin with the second highest property tax rate in New Hampshire with a property tax rate of 3654 followed by Gorham with a property tax rate of 356.

Data and information contained within spreadsheets posted to the internet by the Department of Revenue Administration Department is intended for informational purposes only. Completed Public Tax Rates Final. Counties in New Hampshire collect an average of 186 of a propertys assesed fair market value as property tax per year.

Current 2021 tax rate. Providing our citizens with the most current information regarding our town.

Litchfield 2021 Property Tax Rate Set Town Of Litchfield New Hampshire

Budget Replaces Targeted Aid With Tax Cut Disproportionately Benefitting Owners Of Higher Valued Properties Reachinghighernh

Nh Has A Revenue Problem The Property Tax Nh Business Review

2021 Tax Rate Set Hopkinton Nh

About Property Tax Rates In Nh Vt Housing Solutions Real Estate

2020 Tax Rate Set Town Of Nottingham Nh

New Hampshire Property Tax Calculator Smartasset

Understanding New Hampshire Taxes Free State Project

33 Things You Learn While Living In New Hampshire

2013 New Hampshire Tax Rates For Lakes Region Town Sorted By Town And By Rate New Hampshire Town Names Winnipesaukee

The Nh Firenze Hotel In Florence Is In The Perfect Location To Give Guests Easy Access To The Heart Of This Historical City Art And Architecture Past And Pres

Nh Where Rich Towns Like Rye Get Richer And Poor Ones Like Berlin Need Help Indepthnh Orgindepthnh Org

Mark Fernald Why Your Property Taxes Are So High

Understanding New Hampshire Taxes Free State Project

Lakes Region Of New Hampshire Ossipee Lake Lake Winnipesaukee Lake

Wright S Dairy Farm And Bakery Rhode Island History Dairy Farms Rhode Island

Property Tax Information Town Of Exeter New Hampshire Official Website

Tax Rates Ratios Town Of Nottingham Nh

Monroe Nh Community Profile Economic Labor Market Information Bureau Nh Employment Security